Get our latest book recommendations, author news, and competitions right to your inbox.

Contrarian Investment Strategies

The Psychological Edge

Table of Contents

About The Book

The need to switch to a new approach for investing has never been more urgent. The crash of 2008 revealed in dramatic fashion that there are glaring flaws in the theory that underlies all of the prevailing investment strategies—efficient market theory. This theory, and all of the most popular investing strategies, fail to account for major, systematic errors in human judgment that the powerful new research in psychology David Dreman introduces has revealed, such as emotional over-reactions and a host of mental shortcuts in judgment that lead to wild over and under-valuations of stocks, bonds, and commodities and to bubbles and crashes. It also leads to horribly flawed assessments of risk.

Dreman shows exactly how the new psychological findings definitively refute those strategies and reveals how his alternative contrarian strategies do a powerful job of accounting for them. He shows readers how by being aware of these new findings, they can become saavy psychological investors, crash-proofing their portfolios and earning market beating long-term returns. He also introduces a new theory of risk and substantially updates his core contrarian strategies with a number of highly effective methods for facing the most pressing challenges in the coming years, such as greatly increased volatility and the prospect of inflation. This is every investor’s essential guide to optimal investing.

Product Details

- Publisher: Free Press (January 10, 2012)

- Length: 496 pages

- ISBN13: 9781451628951

Raves and Reviews

“David Dreman is known on Wall Street as a contrarian, a label that fails to appreciate his deep knowledge of the market and research into investor psychology. In Contrarian Investment Strategies: The Psychological Edge Dreman lays bare the deficiencies of the efficient market hypothesis, the investment rationale that states stock prices incorporate all known information. He also provides decades worth of data to show the woeful inaccuracy of analysts' forecasts. With the knowledge that the Street is marching to a flawed drumbeat, Dreman offers advice on how to react when markets misprice assets. Dreman has made a career of leaning heavily against the prevailing wind and for the most part, been highly successful. For those wary of following the herd, Dreman's thinking is revealing.” –Hebert Lash, Correspondent, Reuters

Resources and Downloads

High Resolution Images

- Book Cover Image (jpg): Contrarian Investment Strategies eBook 9781451628951

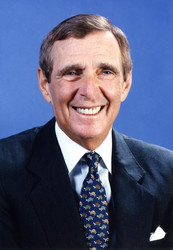

- Author Photo (jpg): David Dreman Dreman Value Management LLC(0.1 MB)

Any use of an author photo must include its respective photo credit